Does flood insurance cover docks? The question is more complex than it appears. Docks, vulnerable to the relentless power of water, occupy a grey area in standard flood insurance policies. Understanding the nuances of coverage, from NFIP guidelines to private insurance options, is crucial for dock owners seeking financial protection against flood damage.

This exploration delves into the intricacies of flood insurance as it pertains to docks. We’ll examine factors influencing coverage, common damage scenarios, policy exclusions, and the steps involved in filing a claim. Furthermore, we’ll explore preventative measures and legal considerations to equip dock owners with the knowledge needed to safeguard their investments.

Understanding Standard Flood Insurance Policies and Docks

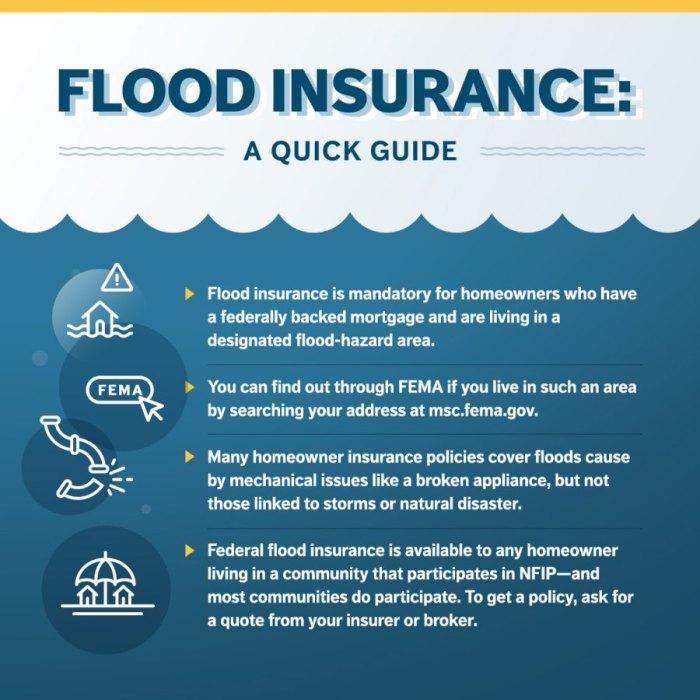

Standard flood insurance policies, primarily offered through the National Flood Insurance Program (NFIP), provide crucial financial protection against losses resulting from flooding. However, the scope of this coverage concerning structures like docks is often a point of confusion for property owners. Understanding the specific inclusions and exclusions is essential for making informed decisions about flood risk management.Standard flood insurance policies cover direct physical losses caused by flooding to insured property.

This coverage typically extends to the building structure and its essential components, as well as personal property within the building, subject to certain limitations and exclusions.

Standard Coverage Provided by the National Flood Insurance Program (NFIP)

The NFIP, managed by FEMA, offers flood insurance to homeowners, renters, and business owners in participating communities. The standard policy provides coverage for direct physical damage caused by a general and temporary condition of partial or complete inundation of normally dry land areas from: the overflow of inland or tidal waters; the unusual and rapid accumulation or runoff of surface waters from any source; mudflow; or the collapse or subsidence of land along the shore of a lake or similar body of water as a result of erosion or undermining caused by waves or currents of water exceeding anticipated cyclical levels that result in flood.

Coverage amounts vary depending on the type of property and the level of coverage purchased.

Types of Structures Typically Covered Under a Standard Flood Insurance Policy

Generally, the NFIP policy covers the following structures:

- The insured building and its foundation.

- Essential equipment and machinery, such as furnaces, water heaters, and air conditioners.

- Permanently installed fixtures and appliances, like refrigerators, stoves, and dishwashers.

- Personal property, subject to certain limitations, such as clothing, furniture, and electronics.

It’s important to note that coverage for personal property is typically limited to items located within an enclosed building.

Classification of Docks Under NFIP Guidelines

Docks present a unique challenge for flood insurance coverage because they are often located outside the primary insured building and are exposed to direct water action. Under NFIP guidelines, docks are generally considered “other structures” and are not typically covered under the standard building property coverage. The NFIP focuses on insuring the main residential or commercial building and its essential contents.

While some limited coverage might be available for certain types of “accessory structures,” docks usually don’t fall under this category. The rationale is that docks are highly vulnerable to flood damage and their repair or replacement costs can be substantial, making them difficult to insure within the standard NFIP framework.

Dock Construction and Vulnerability to Flood Damage

Various types of dock construction exist, each with different levels of vulnerability to flood damage. The materials used and the design of the dock significantly impact its ability to withstand floodwaters.Here are some examples:

- Wooden Docks: These are commonly built using pressure-treated lumber. While relatively inexpensive to construct, wooden docks are susceptible to rot, insect damage, and the force of floodwaters. High water can easily lift and dislodge wooden docks, causing significant damage or complete destruction. An example would be a residential dock on a lake where rising water levels from heavy rains shear the dock from its pilings.

- Concrete Docks: Concrete docks are more durable than wooden docks and can better withstand the impact of floodwaters. However, they are also heavier and more expensive to build. Floodwaters can still damage concrete docks by undermining their foundations or causing cracks and spalling. Consider a large marina with concrete docks; while more resistant to individual wave action, a major storm surge could still overwhelm the structure and cause significant cracking or displacement.

- Composite Docks: Constructed from a blend of recycled plastics and wood fibers, composite docks offer a balance of durability and aesthetics. They are more resistant to rot and insect damage than wood but may still be vulnerable to the force of floodwaters. The plastic components can degrade over time with prolonged exposure to sunlight and water. Imagine a homeowner replacing their wooden dock with a composite material; while it will last longer in normal conditions, a significant flood event could still rip the decking from its frame.

The vulnerability of a dock to flood damage also depends on factors such as its location, the height of the water during a flood event, and the presence of debris. Docks located in areas prone to strong currents or wave action are at a higher risk of damage.

Factors Affecting Flood Insurance Coverage for Docks

Determining whether a dock is covered by flood insurance involves several key considerations for insurance companies. These factors range from the dock’s physical location and construction to adherence to local building codes. Understanding these elements is crucial for dock owners seeking adequate flood protection.The following aspects significantly influence the decision-making process of insurance companies regarding flood insurance coverage for docks.

Each element plays a crucial role in assessing the risk associated with insuring a dock against flood damage.

Dock Location and Coverage Decisions

The proximity of a dock to a body of water is a primary determinant in flood insurance coverage. Docks located in areas with a high risk of flooding, such as those near rivers, lakes, or oceans prone to storm surges, are more likely to be scrutinized and potentially require higher premiums or specific coverage limitations. Insurance companies use flood maps and historical data to assess the flood risk associated with a particular location.For example, a dock situated on a tidal river known for significant flooding during hurricanes will face a higher risk assessment compared to a dock on a small, inland lake with a stable water level.

The closer the dock is to a potential flood source, the greater the perceived risk and the more likely it is to impact the terms of the flood insurance policy.

Construction Materials and Insurability

The materials used to construct a dock significantly affect its vulnerability to flood damage and, consequently, its insurability. Docks built with durable, flood-resistant materials like pressure-treated lumber, composite decking, or concrete pilings are generally considered less risky to insure than those made with less robust materials.* Wood: While commonly used, wood is susceptible to water damage, rot, and impact from debris carried by floodwaters.

Docks constructed primarily of untreated wood may face higher premiums or limited coverage.

Composite Materials

Composite decking and pilings offer enhanced resistance to water damage and decay, making them a more favorable option from an insurance perspective.

Concrete and Steel

These materials provide the greatest protection against flood damage due to their strength and durability. Docks constructed with concrete or steel components are typically viewed as lower risk and may qualify for better insurance rates.

Floating Docks

The type of floatation material used also impacts insurability. Closed-cell foam is more flood resistant than open-cell foam.The structural integrity of the dock, including the method of anchoring and the design of the pilings, also contributes to its overall resilience to flooding. A well-engineered dock designed to withstand flood forces is more likely to be insurable than one that is poorly constructed or maintained.

Impact of Building Codes and Regulations

Local building codes and regulations play a crucial role in determining flood insurance requirements for docks. These codes often specify minimum elevation requirements, construction standards, and permissible materials for docks located in flood-prone areas. Compliance with these regulations is essential for obtaining flood insurance coverage.* Elevation Requirements: Many jurisdictions require docks to be elevated above the base flood elevation (BFE) to minimize the risk of flood damage.

Docks that do not meet these elevation requirements may be ineligible for flood insurance or subject to higher premiums.

Construction Standards

Building codes may also dictate the types of materials and construction methods that are permitted for docks in flood zones. These standards are designed to ensure that docks are built to withstand the forces of floodwaters.

Permitting Process

Obtaining the necessary permits for dock construction is a critical step in ensuring compliance with local regulations. Insurance companies may require proof of permits before issuing a flood insurance policy.Failure to comply with local building codes can result in denial of flood insurance coverage or the voiding of an existing policy. Dock owners should consult with local authorities and insurance professionals to ensure that their docks meet all applicable requirements.

Common Scenarios: Docks Damaged by Flooding

Floodwaters pose a significant threat to docks, resulting in a variety of damage scenarios. Understanding these potential damages is crucial for dock owners seeking adequate flood insurance coverage. The extent of damage can range from minor repairs to complete destruction, depending on the severity of the flood and the dock’s construction.The following sections detail common ways in which floodwaters can impact and damage docks, illustrating the vulnerability of these structures to flood events.

Direct Floodwater Damage to Dock Structure

Floodwaters themselves can exert tremendous force, directly damaging a dock’s structure. This occurs when the water level rises significantly, putting pressure on the dock’s components. The water’s force can break pilings, dislodge decking, and even lift entire sections of the dock. The severity of the damage depends on factors like the dock’s construction materials, its age, and the speed and depth of the floodwaters.Consider a scenario where a poorly maintained wooden dock is subjected to rapidly rising floodwaters.

The water seeps into the wood, weakening its structural integrity. As the water level continues to rise, the force against the pilings increases, potentially causing them to snap or buckle. The decking, already weakened by rot, may become detached and float away.

Debris Impact Damage to Docks

Floodwaters often carry a large amount of debris, including trees, branches, boats, and other floating objects. This debris can act as projectiles, impacting docks with significant force and causing substantial damage. The impact can break pilings, puncture decking, and damage support structures.For example, during a flash flood event, a large tree trunk carried by the raging waters could slam into a dock, severing a piling and causing a section of the dock to collapse.

Similarly, a boat that has broken free from its moorings could collide with a dock, causing significant structural damage. The accumulation of smaller debris, such as branches and trash, can also weigh down the dock, increasing the stress on its support system.

Erosion Damage to Dock Foundations

Flooding can cause significant erosion around a dock’s foundation, undermining its stability. The rushing water scours away the soil surrounding the pilings, reducing their ability to support the dock’s weight. This erosion can lead to the dock sinking, tilting, or even collapsing entirely.Imagine a dock built on a sandy shoreline. During a prolonged period of flooding, the water continuously washes away the sand around the pilings.

Over time, the pilings become exposed and lose their grip on the ground. The dock begins to sag and tilt, eventually becoming unusable. In extreme cases, the entire dock could collapse into the water. Proper soil stabilization techniques and regular maintenance are crucial in preventing erosion-related damage.

Hypothetical Scenario: Hurricane Surge Damage

Consider a hypothetical scenario where a dock is located in a coastal area that experiences a direct hit from a Category 3 hurricane. The hurricane surge, reaching a height of 10 feet above the normal high tide line, inundates the dock.The likely damage patterns would be as follows:* Complete Submersion and Structural Failure: The surge’s force would likely submerge the entire dock, placing immense pressure on its structure.

The pilings, even if initially strong, would be subjected to extreme lateral forces, potentially causing them to snap or shear off at the waterline. The decking, if not securely fastened, would be ripped away and scattered by the waves.* Widespread Debris Damage: The surge would carry a large amount of debris, including boats, pieces of other docks, and coastal vegetation.

This debris would repeatedly slam into the dock, causing further structural damage. The impact could puncture the decking, break railings, and damage any equipment stored on the dock.* Severe Erosion and Foundation Undermining: The powerful surge would cause significant erosion around the dock’s foundation. The soil surrounding the pilings would be scoured away, further weakening their support. The dock could sink, tilt, or even be completely uprooted and carried away by the surge.

The surrounding shoreline would also be severely eroded, potentially affecting the stability of nearby structures.* Saltwater Intrusion and Corrosion: The saltwater intrusion caused by the surge would accelerate corrosion of metal components, such as fasteners, brackets, and pilings. This corrosion would further weaken the dock’s structure and increase the likelihood of future failures.* Damage to Electrical Systems: If the dock has any electrical systems, such as lighting or power outlets, these would likely be severely damaged by the saltwater intrusion.

The electrical components would corrode, and the wiring could short circuit, posing a safety hazard.

Exclusions and Limitations in Flood Insurance Policies

Flood insurance policies, while designed to protect property owners from devastating losses, come with specific exclusions and limitations. Understanding these nuances is crucial for dock owners to assess the extent of their coverage and identify potential gaps. These limitations can significantly impact the amount of compensation received after a flood event, or even result in a claim denial.

Common Exclusions in Flood Insurance Policies That May Apply to Docks

Flood insurance policies, including those offered by the National Flood Insurance Program (NFIP), typically exclude coverage for certain types of property and damage. These exclusions can be particularly relevant to docks and waterfront structures.The following are some common exclusions that might affect dock coverage:* Land Erosion: Policies typically do not cover losses caused by land erosion, even if the erosion is a result of flooding.

This means that if a dock is damaged or destroyed due to the land underneath it washing away, the damage may not be covered.

Pre-existing Damage

Damage that existed before the flood event is generally not covered. This includes wear and tear, deterioration, or faulty construction. It is essential to maintain a dock in good condition to avoid claim denials based on pre-existing damage.

Valuable Papers, Stock, and Currency

Flood insurance policies generally do not cover valuable papers, stock certificates, and currency. While these items are unlikely to be stored on a dock, it’s important to be aware of the general exclusions in the policy.

Loss of Use

Flood insurance policies typically do not cover loss of use of the dock, such as lost rental income or the inability to use the dock for recreational purposes.

Structures Entirely Over Water

The NFIP generally does not cover structures that are entirely over water and not connected to land. A dock connected to the shore would generally not be considered in this category, but floating docks or platforms detached from the land might be.

Certain Accessory Structures

Some policies may limit or exclude coverage for certain accessory structures, which might include docks depending on how they are classified and their connection to the main property.

Damage from Neglect or Failure to Maintain

If damage results from the owner’s failure to take reasonable steps to protect the property from flood damage or to maintain it properly, the claim could be denied. For example, failing to repair known structural issues on a dock.

Limitations on Coverage Amounts for Structures Like Docks

Flood insurance policies also have limitations on the amount of coverage available for certain types of structures. These limitations can affect the amount of compensation a dock owner receives after a flood.The following are some common limitations to consider:* Coverage Limits: The NFIP has maximum coverage limits for both building and personal property. For example, the standard NFIP policy provides up to $250,000 in building coverage and $100,000 in personal property coverage for single-family homes.

Docks are typically considered part of the building structure if they are permanently attached to the property. However, determining how a dock is classified and its coverage limit can be complex. It’s important to discuss this with an insurance agent.

Replacement Cost vs. Actual Cash Value

Flood insurance policies may pay for damage on a replacement cost basis or an actual cash value (ACV) basis. Replacement cost coverage pays the cost to replace the damaged property with new property, while ACV coverage pays the replacement cost less depreciation. Docks, due to their exposure to the elements, can depreciate quickly. An ACV policy will likely result in a lower payout than a replacement cost policy.

Deductibles

Flood insurance policies have deductibles, which are the amounts the policyholder must pay out of pocket before the insurance company pays for the remaining damage. Higher deductibles typically result in lower premiums, but they also mean a higher out-of-pocket expense in the event of a flood.

Detached Structures

Some policies may treat docks as detached structures, which could be subject to different coverage limits or exclusions. For example, a detached garage might have a lower coverage limit than the main house. It is crucial to understand how the policy defines and treats detached structures, especially if the dock is not directly connected to the main dwelling.

Scenarios Where Damage Might Be Attributed to Causes Other Than Flooding

Not all damage to a dock is necessarily caused by flooding, and flood insurance policies typically only cover damage directly caused by a flood event. Damage caused by other factors may not be covered.Here are some scenarios where damage might be attributed to causes other than flooding:* Ice Damage: In colder climates, ice buildup can exert significant pressure on docks, causing structural damage.

Flood insurance policies typically do not cover damage caused by ice. For instance, a dock collapsing under the weight of accumulated ice during the winter would not be covered.

Wind Damage

High winds can damage docks, especially those that are not properly secured or maintained. While some wind damage may be covered under a homeowner’s insurance policy, it is generally not covered under a flood insurance policy unless the wind damage occurred in conjunction with a flood.

Wave Action (Non-Flood)

Wave action can damage docks, even in the absence of a flood. If the wave action is not caused by a flood event, the damage may not be covered. For example, damage caused by wakes from boats or normal tidal action is typically not covered.

Faulty Construction or Design

If a dock is poorly constructed or designed, it may be more susceptible to damage from various factors, including flooding. However, the flood insurance policy may not cover damage that is attributed to the faulty construction or design.

Wear and Tear

Gradual deterioration of the dock due to normal wear and tear is not covered by flood insurance. This includes rotting wood, rusting metal, or other forms of degradation that occur over time. Regular maintenance is essential to prevent wear and tear from leading to significant damage.

Animal Damage

Damage caused by animals, such as beavers gnawing on wooden structures, is generally not covered by flood insurance.

Examples of Policy Riders or Endorsements That Might Extend Coverage to Docks

While standard flood insurance policies have limitations, it may be possible to obtain policy riders or endorsements that extend coverage to docks or provide additional protection. These options can vary depending on the insurance provider and the specific circumstances of the property.The following are some examples of policy riders or endorsements that might be available:* Increased Coverage Limits: Some insurance companies may offer riders that increase the coverage limits for building or personal property.

This can be helpful for dock owners who need more coverage than the standard NFIP limits provide. For instance, if a dock is particularly valuable or expensive to replace, increasing the coverage limit can provide greater financial protection.

Replacement Cost Coverage

As mentioned earlier, some flood insurance policies pay for damage on an actual cash value (ACV) basis. A rider may be available to upgrade the coverage to replacement cost, which would pay the full cost to replace the damaged property with new property, without deducting for depreciation. This can be especially beneficial for docks, which can depreciate quickly due to their exposure to the elements.

Debris Removal

Some policies may offer a rider that covers the cost of debris removal after a flood event. This can be a significant expense, especially if the dock is severely damaged and requires extensive cleanup.

Coverage for Detached Structures

If the standard policy has limitations on coverage for detached structures, a rider may be available to provide additional coverage for docks that are considered detached.

Specific Peril Coverage

In some cases, it may be possible to obtain a rider that provides coverage for specific perils that are not typically covered by the standard flood insurance policy. For example, a rider might be available to cover damage caused by ice or wave action (not related to a flood event).

Business Interruption Coverage

For commercial docks or marinas, a rider may be available to cover business interruption losses, such as lost rental income, due to flood damage.It’s essential to consult with an insurance agent to discuss available policy riders and endorsements and determine which options are best suited to the specific needs of the dock owner. Carefully reviewing the policy language and understanding the terms and conditions of any riders or endorsements is crucial to ensure adequate coverage.

Private Flood Insurance Options for Docks

While the National Flood Insurance Program (NFIP) is the primary source of flood insurance in the United States, private flood insurance offers alternative options, especially concerning structures like docks that may have limited or no coverage under the NFIP. Private flood insurance policies are offered by various insurance companies and can provide broader coverage, higher coverage limits, or more flexible terms compared to the NFIP.

Understanding the nuances of these private options is crucial for dock owners seeking comprehensive flood protection.Private flood insurance policies present a viable alternative to the NFIP, often tailored to individual needs and circumstances. These policies can offer advantages in terms of coverage scope, policy limits, and the speed of claims processing. However, they also come with their own set of considerations, including potentially higher premiums and variations in coverage terms.

Compare and Contrast Private Flood Insurance Policies with the NFIP Regarding Dock Coverage

Private flood insurance and the NFIP differ significantly in their approach to covering docks. The NFIP typically provides very limited coverage for docks, often considering them “other structures” with restrictions on the amount of coverage available. Private insurers, on the other hand, may offer more comprehensive coverage options specifically designed for docks, including coverage for damage to pilings, decking, and attached equipment.Here’s a breakdown of key differences:* Coverage Scope: NFIP policies usually offer minimal coverage for docks, treating them as appurtenant structures with limited payouts.

Private policies can offer broader coverage, including structural damage, debris removal, and even loss of use.

Policy Limits

The NFIP has fixed coverage limits, which may not be sufficient for expensive docks. Private insurers often provide higher coverage limits, allowing dock owners to fully protect their investment.

Flexibility

NFIP policies are standardized, offering little room for customization. Private policies can be tailored to specific needs, with options for additional endorsements and riders.

Claims Process

The NFIP claims process can be lengthy and bureaucratic. Private insurers often offer faster and more streamlined claims processing.

Detail the Advantages and Disadvantages of Obtaining Private Flood Insurance for Docks

Obtaining private flood insurance for docks presents both advantages and disadvantages that dock owners must carefully weigh. Advantages:* Broader Coverage: Private policies often cover a wider range of damages, including those not covered by the NFIP, such as damage from wave action or erosion.

Higher Coverage Limits

Private insurers typically offer higher coverage limits, which can be crucial for expensive docks. This can be particularly important in areas where dock construction costs are high.

Customizable Policies

Private policies can be tailored to specific needs, with options for additional endorsements and riders. This allows dock owners to create a policy that perfectly matches their risk profile.

Faster Claims Processing

Private insurers often offer faster and more efficient claims processing compared to the NFIP. This can be critical in getting docks repaired quickly after a flood. Disadvantages:* Higher Premiums: Private flood insurance policies generally come with higher premiums than NFIP policies. This reflects the broader coverage and higher limits offered.

Variable Coverage Terms

Private policies can vary significantly in their coverage terms, making it essential to carefully review the policy language. Some policies may have exclusions or limitations that are not present in NFIP policies.

Financial Stability of Insurer

It is crucial to assess the financial stability of the private insurer to ensure they can pay out claims in the event of a major flood.

Availability

Private flood insurance may not be available in all areas, particularly those with a high risk of flooding.

Explain How to Research and Compare Private Flood Insurance Providers

Researching and comparing private flood insurance providers is essential to ensure you obtain the best coverage at the most competitive price.Here’s a step-by-step guide:

1. Identify Potential Providers

Start by identifying private flood insurance providers that operate in your area. You can use online search engines, insurance brokers, or referrals from other dock owners.

2. Obtain Quotes

Request quotes from multiple providers, providing them with detailed information about your dock, including its location, construction materials, and value.

3. Review Policy Language

Carefully review the policy language of each quote, paying close attention to the coverage scope, exclusions, and limitations.

4. Compare Coverage Options

Compare the coverage options offered by each provider, focusing on areas that are important to you, such as coverage for structural damage, debris removal, and loss of use.

5. Assess Financial Stability

Assess the financial stability of each provider by checking their ratings from independent rating agencies such as A.M. Best or Standard & Poor’s.

6. Read Customer Reviews

Read customer reviews to get an idea of the provider’s customer service and claims handling process.

7. Consult with an Insurance Broker

Consider consulting with an independent insurance broker who can help you navigate the complexities of private flood insurance and find the best policy for your needs.

Create an HTML Table with 4 Responsive Columns Comparing NFIP and Private Flood Insurance Options for Dock Coverage, Including Columns for “Coverage Scope,” “Cost,” “Availability,” and “Exclusions.”

The following table provides a comparison between NFIP and private flood insurance options for dock coverage:“`html

| Feature | NFIP | Private Flood Insurance |

|---|---|---|

| Coverage Scope | Limited coverage for docks as “other structures.” Typically covers structural damage to a limited extent. | Potentially broader coverage, including structural damage, debris removal, and loss of use. Can be tailored to specific dock features. |

| Cost | Generally lower premiums compared to private insurance, but may not reflect actual risk. | Generally higher premiums due to broader coverage and higher limits. Premiums can vary widely based on risk assessment. |

| Availability | Available in most communities that participate in the NFIP. | Availability can be limited depending on location and risk assessment. Not available in all areas. |

| Exclusions | Strict exclusions, including coverage for wave action, erosion, and pre-existing conditions. | Exclusions vary by policy but may include certain types of damage, specific weather events, or lack of maintenance. Carefully review policy language. |

“`This table highlights the key differences between NFIP and private flood insurance, enabling dock owners to make informed decisions about their coverage needs. The “Coverage Scope” column details the extent of protection offered for dock-related damages. The “Cost” column addresses the financial aspect, indicating the premium ranges and factors influencing them. The “Availability” column specifies where each type of insurance is accessible, considering geographical limitations.

Finally, the “Exclusions” column Artikels the limitations and conditions under which coverage may not apply. Understanding these distinctions is crucial for selecting the most suitable flood insurance policy for a dock.

Steps to Take After a Flood to File a Claim for Dock Damage

After a flood event impacts your property, especially damaging a dock, it’s crucial to act quickly and methodically to protect your interests and ensure a smooth insurance claim process. The immediate actions you take can significantly influence the outcome of your claim. Documenting the damage thoroughly and understanding the claims process are essential steps.Filing a flood insurance claim for dock damage involves several key steps, from immediate safety precautions to submitting the necessary paperwork.

Understanding each stage of this process helps ensure that your claim is processed efficiently and accurately.

Immediate Actions After a Flood Event

The first priority after a flood is safety. Before inspecting your dock, ensure the area is safe from hazards like electrical wires or structural instability. Once safe, promptly begin documenting the damage. This includes taking photographs and videos of the dock and surrounding area. It is vital to prevent further damage if possible, but only if it can be done safely.

Documenting Flood Damage to a Dock

Thorough documentation is the cornerstone of a successful flood insurance claim. Capture detailed photos and videos of the damage, including close-ups and wide shots. Note the water level reached on the dock and any debris deposited by the floodwaters. Obtain estimates from qualified contractors for the repair or replacement of the dock. Gather any existing documentation related to the dock, such as construction permits, original purchase receipts, and previous inspection reports.

Filing a Flood Insurance Claim for Dock Damage

Contact your flood insurance provider as soon as possible after the flood event. They will provide you with the necessary claim forms and instructions. Complete the claim form accurately and thoroughly, providing all requested information. Include all supporting documentation, such as photographs, videos, repair estimates, and receipts. Be prepared to meet with a claims adjuster who will inspect the damage and assess the loss.

Cooperate fully with the adjuster and provide any additional information they request.

Essential Documents Checklist for Filing a Flood Claim

To ensure a smooth and efficient claims process, gather the following documents before filing your claim. These documents provide a comprehensive record of the damage and the dock’s history, aiding in the assessment process.Here’s a checklist of essential documents:* A copy of your flood insurance policy.

- Photographs and videos of the flood damage to the dock.

- Detailed repair estimates from licensed contractors.

- Original receipts or invoices for the dock’s construction or any prior repairs.

- Any available documentation of the dock’s specifications, such as blueprints or permits.

- A written description of the flood event, including the date, time, and estimated water level.

- Contact information for any witnesses to the flood damage.

Maintenance and Prevention to Minimize Flood Damage to Docks

Docks, being directly exposed to water and weather, are particularly vulnerable to flood damage. Implementing a comprehensive maintenance and prevention plan is crucial for minimizing potential losses and ensuring the longevity of the structure. Proactive measures can significantly reduce the impact of flooding, protecting your investment and mitigating the risks associated with water damage.A well-structured maintenance plan, coupled with appropriate reinforcement techniques and pre-flood preparedness, forms the cornerstone of effective flood mitigation for docks.

These strategies not only safeguard the physical structure but also contribute to the overall safety and usability of the dock in the long run.

Design a Preventative Maintenance Plan to Reduce the Risk of Flood Damage to Docks

A preventative maintenance plan is essential for identifying and addressing potential vulnerabilities before a flood occurs. Regular inspections and timely repairs can significantly reduce the risk of damage and extend the lifespan of the dock.Consider the following elements when designing a preventative maintenance plan:

- Regular Inspections: Conduct thorough inspections at least twice a year, ideally before and after the flood season. Check for signs of rot, corrosion, or damage to pilings, decking, and connection points. Look for loose or missing fasteners and any evidence of structural weakness.

- Piling Assessment: Examine pilings for signs of decay, insect infestation, or erosion. Pay close attention to the waterline area, where pilings are most susceptible to damage. Consider using protective wraps or coatings to prevent further deterioration.

- Decking and Framing Inspection: Inspect decking boards for cracks, splits, or warping. Ensure that framing members are securely attached and free from rot or damage. Replace any compromised components immediately.

- Hardware and Fastener Check: Inspect all hardware, including bolts, screws, and connectors, for corrosion or loosening. Replace any damaged or weakened hardware with marine-grade materials.

- Electrical System Maintenance: If the dock has electrical wiring, ensure it is properly grounded and protected from water damage. Inspect wiring for frayed insulation or loose connections. Consider installing a ground fault circuit interrupter (GFCI) to prevent electrical shocks.

- Floating Dock Component Check: For floating docks, inspect the floats for leaks, punctures, or deterioration. Ensure that the floats are properly secured to the frame and that the connection points are in good condition.

Methods to Reinforce Dock Structures Against Floodwaters

Reinforcing dock structures can significantly improve their resistance to floodwaters. Implementing these methods during construction or as part of a renovation project can provide added protection against potential damage.Several methods can be employed to reinforce docks:

- Piling Reinforcement: Strengthen pilings by wrapping them with fiberglass or concrete jackets. This provides added protection against erosion, impact damage, and decay.

- Increased Piling Depth and Diameter: When constructing a new dock, consider using deeper and wider pilings to provide greater stability and resistance to flood forces. This is particularly important in areas prone to strong currents or wave action.

- Stronger Connection Points: Use heavy-duty connectors and fasteners to secure decking, framing, and pilings. Ensure that all connections are properly tightened and protected from corrosion.

- Breakaway Designs: Incorporate breakaway designs into the dock structure to allow sections to detach in the event of extreme flooding. This can help to prevent the entire dock from being destroyed.

- Wave Attenuation Systems: Install wave attenuation systems, such as breakwaters or floating barriers, to reduce the impact of waves on the dock. These systems can help to minimize the force of floodwaters and protect the dock from damage.

How to Properly Secure a Dock Before a Predicted Flood Event

Properly securing a dock before a predicted flood event can significantly reduce the risk of damage. Taking proactive steps to protect the dock can save time, money, and prevent potential safety hazards.Consider the following steps when securing a dock before a flood:

- Remove Loose Items: Remove all loose items from the dock, including furniture, equipment, and supplies. Store these items in a safe location above the expected flood level.

- Secure Floating Docks: For floating docks, ensure that they are securely anchored to the shoreline or pilings. Use heavy-duty ropes or chains to prevent the dock from drifting away. Consider adding extra anchors or tie-downs for added security.

- Raise Electrical Components: If possible, raise electrical components, such as outlets and wiring, above the expected flood level. This can help to prevent electrical damage and potential safety hazards.

- Disconnect Utilities: Disconnect all utilities, such as electricity and water, to the dock. This can help to prevent damage to the utilities and potential safety hazards.

- Document the Dock’s Condition: Take photos and videos of the dock’s condition before the flood. This documentation can be helpful when filing an insurance claim after the event.

Illustrate Various Methods for Securing a Dock Against Flood Damage, Such as Using Tie-Downs, Pilings, or Breakaway Designs

Various methods can be employed to secure a dock against flood damage, each offering different levels of protection depending on the specific circumstances. Tie-downs, pilings, and breakaway designs are among the most common and effective approaches.* Tie-Downs: Tie-downs involve using strong ropes or cables to secure the dock to fixed points on land or to deeply anchored pilings.

The ropes should be made of a durable, weather-resistant material and be of sufficient length to allow for some rise in water level without putting undue stress on the dock structure. The anchor points on land should be robust and firmly embedded in the ground. For floating docks, tie-downs are crucial to prevent them from drifting away during a flood.* Pilings: Pilings are vertical supports driven deep into the seabed or riverbed.

The dock is then attached to these pilings, providing a stable and elevated platform. The height of the pilings should be sufficient to keep the dock above the expected flood level. Pilings are particularly effective in areas with strong currents or wave action. The pilings must be properly spaced and of adequate diameter to withstand the forces exerted by floodwaters.

Regular inspection of the pilings is essential to identify any signs of erosion or decay.* Breakaway Designs: Breakaway designs incorporate sections that are intentionally designed to detach from the main structure under extreme flood conditions. This prevents the entire dock from being destroyed by the force of the water. The breakaway sections are typically connected to the main structure with weaker fasteners or connections that are designed to fail under a certain amount of stress.

While breakaway designs may result in some damage, they can significantly reduce the overall cost of repairs and prevent the complete loss of the dock. The detached sections can be retrieved and reattached after the floodwaters recede. The key is to ensure that the breakaway points are strategically located to minimize damage to the remaining structure.

Legal and Regulatory Considerations for Dock Construction and Insurance

Navigating dock construction and insurance requires a thorough understanding of the complex web of federal, state, and local regulations. These regulations aim to protect waterways, ensure public safety, and manage flood risks. Understanding these legal frameworks is crucial for dock owners to avoid costly penalties, ensure insurability, and mitigate potential flood damage.Dock construction and insurance are governed by various legal and regulatory frameworks that aim to protect the environment, ensure public safety, and manage flood risks.

Dock owners must be aware of these regulations to avoid legal issues and ensure proper insurance coverage.

Relevant Federal, State, and Local Regulations

Dock construction and insurance are influenced by regulations at all levels of government. Federal regulations often focus on environmental protection and navigation, while state and local regulations address specific construction standards, zoning requirements, and flood risk management.Here are some key regulatory areas:

- Federal Regulations: The U.S. Army Corps of Engineers (USACE) plays a significant role in regulating dock construction, particularly in navigable waters. Section 10 of the Rivers and Harbors Act of 1899 requires permits for any work that affects navigable waters of the United States. The Clean Water Act also impacts dock construction by regulating the discharge of pollutants into waterways.

- State Regulations: States often have their own permitting processes and environmental regulations that overlap with federal requirements. These may include regulations related to coastal zone management, wetlands protection, and water quality standards. For example, many coastal states have specific regulations governing the materials used in dock construction to minimize environmental impact.

- Local Regulations: Local governments typically have zoning ordinances and building codes that govern dock construction. These regulations may address setbacks from property lines, maximum dock size, and aesthetic considerations. Additionally, local floodplain management ordinances may impose stricter requirements for dock construction in flood-prone areas.

Permitting Requirements for Dock Construction in Flood-Prone Areas

Constructing a dock in a flood-prone area necessitates adherence to stringent permitting requirements, ensuring that the structure is both safe and environmentally sound. These requirements often involve multiple layers of approval from federal, state, and local authorities, each with specific criteria to be met.The permitting process typically involves:

- Floodplain Development Permit: Local governments participating in the National Flood Insurance Program (NFIP) require floodplain development permits for any construction within designated flood zones. This permit ensures that the proposed construction complies with local floodplain management ordinances, which are designed to minimize flood damage.

- Elevation Certificates: An elevation certificate is often required to demonstrate that the lowest floor of the dock (or its supporting structure) is elevated above the base flood elevation (BFE). This helps to reduce the risk of flood damage and can also affect flood insurance rates.

- Environmental Impact Assessments: Depending on the size and location of the dock, an environmental impact assessment may be required to evaluate the potential effects on wetlands, water quality, and aquatic habitats. This assessment may need to address potential impacts on endangered species or sensitive ecosystems.

Legal Responsibilities of Dock Owners Regarding Flood Risk Mitigation

Dock owners have a legal responsibility to take reasonable measures to mitigate flood risk and prevent damage to their property and the surrounding environment. This responsibility extends to ensuring that the dock is constructed and maintained in accordance with applicable regulations and industry best practices.These responsibilities include:

- Compliance with Building Codes and Regulations: Dock owners must ensure that their docks are built and maintained in compliance with all applicable building codes, zoning ordinances, and floodplain management regulations. Failure to comply can result in fines, penalties, and even legal action.

- Regular Inspections and Maintenance: Regular inspections and maintenance are essential to identify and address potential flood risks. This includes checking for signs of deterioration, such as rotting wood or corroded metal, and making necessary repairs to ensure the structural integrity of the dock.

- Floodproofing Measures: Dock owners should consider implementing floodproofing measures to protect their docks from flood damage. This may include elevating the dock above the base flood elevation, using flood-resistant materials, and securing the dock to prevent it from being dislodged by floodwaters.

Relevant Legal Precedents Regarding Dock Insurance Claims in Flood Events

Court cases involving dock insurance claims in flood events often hinge on the interpretation of policy language, the cause of the damage, and the extent to which the dock owner took reasonable measures to mitigate flood risk. These cases provide valuable insights into how courts interpret flood insurance policies and the responsibilities of dock owners.

“InSmith v. National Flood Insurance Program*, the court ruled that damage to a dock caused by erosion resulting from a flood was not covered under the standard flood insurance policy, as erosion is a specifically excluded peril.”

“InJones v. FEMA*, the court held that a dock owner was not entitled to coverage for damage caused by wind-driven waves during a flood event, as the policy excluded coverage for damage caused by wind unless the flood itself was the proximate cause of the damage.”

These cases highlight the importance of carefully reviewing the policy language and understanding the exclusions and limitations of flood insurance policies. They also underscore the importance of taking reasonable measures to mitigate flood risk, as failure to do so can jeopardize insurance coverage. Dock owners should consult with legal and insurance professionals to ensure that they are adequately protected against flood damage.

Case Studies: Real-World Examples of Flood Insurance Claims for Docks

Understanding how flood insurance applies to docks is crucial for waterfront property owners. Examining real-world case studies of flood insurance claims, both successful and denied, offers valuable insights into the complexities of coverage and the importance of proper documentation and policy understanding. These examples highlight the factors insurance companies consider when evaluating claims for dock damage caused by flooding.Analyzing past flood events and their impact on dock insurance practices can help property owners and insurers alike better prepare for future risks.

By learning from these experiences, both parties can improve their understanding of coverage limitations, implement preventative measures, and ensure fair and accurate claims processing.

Successful Flood Insurance Claims for Dock Damage

Several factors contribute to the success of a flood insurance claim for dock damage. These often include clear evidence of flood-related damage, compliance with building codes, and a thorough understanding of the policy’s terms and conditions. Below are some common characteristics of successful claims:* Direct Flood Damage: The damage must be directly attributable to flooding, such as submersion, erosion, or impact from debris carried by floodwaters.

Proper Documentation

Detailed photographs and videos of the damage, along with repair estimates from qualified contractors, are essential.

Policy Compliance

The policyholder must be in compliance with all policy requirements, including timely premium payments and adherence to any required flood mitigation measures.

Denied Flood Insurance Claims for Dock Damage

Flood insurance claims for dock damage can be denied for various reasons, often related to policy exclusions, pre-existing conditions, or insufficient evidence of flood-related damage. Understanding these reasons is critical for property owners seeking flood insurance coverage for their docks.* Lack of Proof of Flood Damage: If the damage can be attributed to other causes, such as wind, waves (unless directly caused by a flood), or general wear and tear, the claim may be denied.

Policy Exclusions

Standard flood insurance policies often exclude coverage for certain types of structures or damage, such as damage caused by erosion or land subsidence.

Pre-Existing Conditions

Damage that existed prior to the flood event may not be covered. Insurance companies typically require evidence that the damage was directly caused by the flood.

Lessons Learned from Past Flood Events

Past flood events have significantly shaped dock insurance practices. These events have highlighted the importance of accurate flood zone mapping, stringent building codes for waterfront structures, and comprehensive flood insurance policies that adequately address the unique risks associated with docks.Following significant flood events, insurance companies often re-evaluate their risk assessments and adjust their coverage terms and premiums accordingly. Property owners, in turn, are encouraged to take proactive steps to mitigate flood risks, such as elevating their docks, using flood-resistant materials, and developing emergency preparedness plans.Here is a table summarizing different case studies of dock flood damage claims:

| Location | Type of Damage | Insurance Outcome | Key Takeaway |

|---|---|---|---|

| Coastal North Carolina | Dock pilings weakened and partially collapsed due to storm surge. | Claim approved after engineer confirmed flood-related damage. | Professional assessment is crucial for establishing cause of damage. |

| Florida Keys | Dock decking and walkways washed away by hurricane-induced flooding. | Claim approved, covering replacement of decking and walkways. | Adequate documentation (photos, videos) speeds up claim processing. |

| Louisiana Bayou | Extensive damage to dock structure due to prolonged submersion in floodwaters. | Claim denied due to policy exclusion for pre-existing rot and decay. | Regular maintenance is essential to prevent claim denials. |

| Chesapeake Bay, Maryland | Dock detached from shoreline due to rapid erosion caused by flooding. | Claim denied; policy didn’t cover erosion damage. | Understand policy exclusions regarding erosion and land movement. |

| Puget Sound, Washington | Dock damaged by debris carried by floodwaters during a heavy rain event. | Claim approved after proving the debris damage was directly flood-related. | Clearly establish the connection between the flood and the specific damage. |

Conclusion

Navigating the complexities of flood insurance for docks requires careful consideration of various factors, from policy specifics to preventative measures. Understanding NFIP limitations, exploring private insurance options, and proactively maintaining your dock are key to mitigating potential financial losses from flood damage. Armed with this knowledge, dock owners can make informed decisions to protect their waterfront investments.